XBRL Services Provider for ACRA filing.

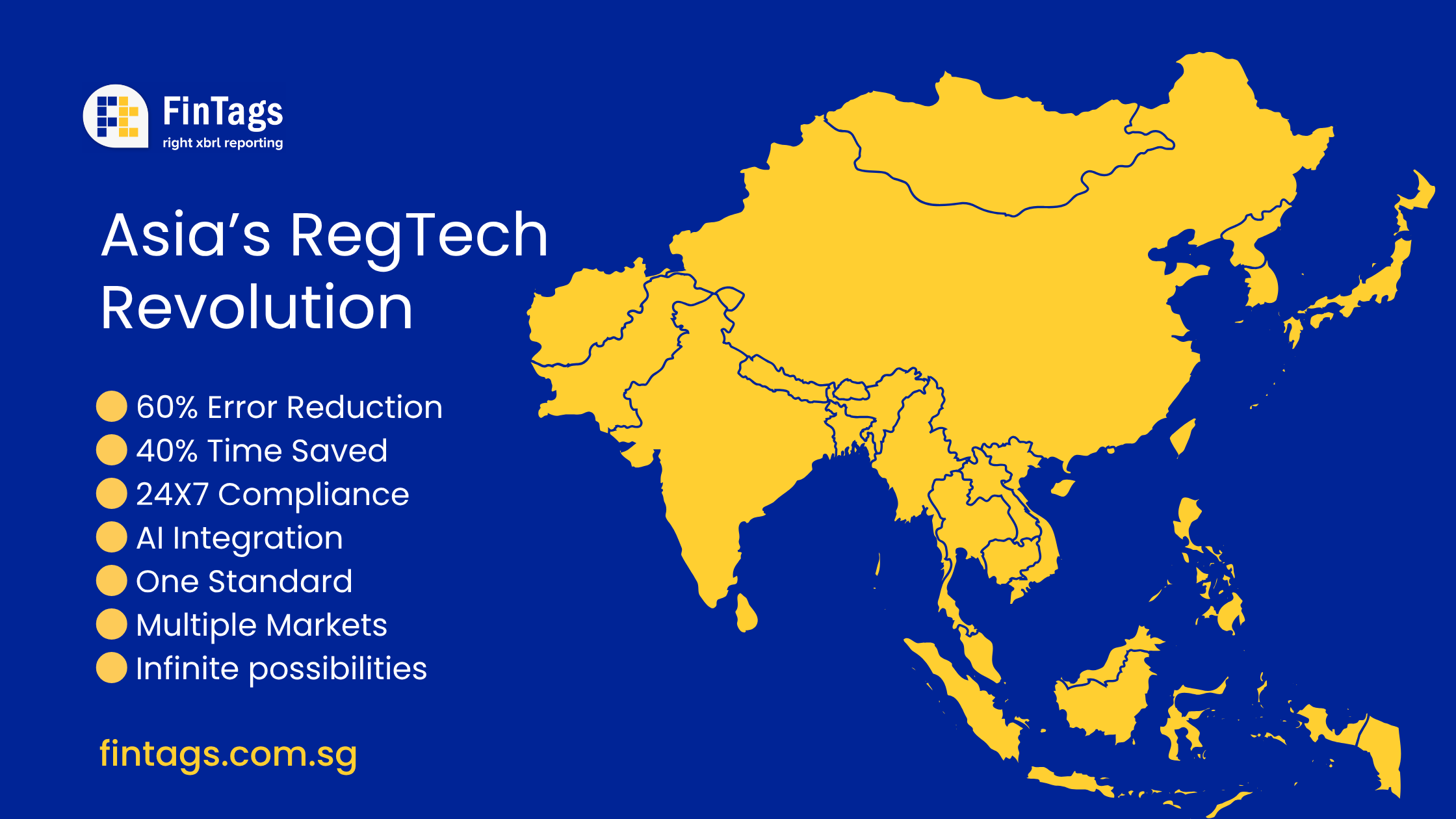

Regulatory Technology (RegTech) is revolutionizing compliance processes across Asia. With rapid digital transformation and diverse regulatory environments, financial institutions are turning to technology for smarter, faster, and more cost-effective solutions.

RegTech refers to technology-driven solutions that streamline regulatory compliance. It involves tools that automate compliance monitoring, reporting, and risk management. From AI-driven fraud detection to blockchain-based transaction monitoring, RegTech solutions are becoming indispensable.

A prime example of RegTech in action is Singapore's implementation of XBRL (eXtensible Business Reporting Language) through ACRA's BizFiling system. This structured data format has transformed how companies submit financial statements, automatically standardizing and digitizing financial information while reducing manual errors and processing time. What once required weeks of manual review can now be processed and validated within hours.

Asia-Pacific's financial ecosystem is characterized by:

Singapore's ACRA has emerged as a regional leader in RegTech implementation through its comprehensive XBRL program. The BizFiling system has delivered measurable benefits:

This success has positioned Singapore as a model for other Asian jurisdictions considering similar digital transformation initiatives.

However, these challenges present opportunities for collaborative innovation and growth. The success of Singapore's XBRL implementation demonstrates that with proper planning and support, even complex RegTech initiatives can deliver substantial benefits.

As we look toward the rest of 2025 and beyond, several developments are shaping the RegTech landscape:

As Asia cements its position as a RegTech hub, financial institutions must embrace these solutions to stay ahead of regulatory demands. Singapore's leadership in XBRL implementation through ACRA's BizFiling system demonstrates how RegTech can transform compliance from a burden into a competitive advantage.

By adopting structured data standards like XBRL, companies can achieve not only compliance but also operational efficiency, enhanced data quality, and improved stakeholder trust. The future of financial reporting in Asia is digital, structured, and intelligent – and the organizations that embrace this transformation today will be the compliance leaders of tomorrow.

For businesses looking to navigate Asia's evolving RegTech landscape, partnering with experienced XBRL tagging specialists can ensure seamless compliance across multiple jurisdictions while maximizing the strategic benefits of structured financial data. Talk to our team today!

Write your comments